On Friday, February 24th, the most recent reading of the University of Michigan Consumer Sentiment Index was released. It came in at 67.0 for February which is an increase from January’s reading of 64.9.

As the name would imply, the University of Michigan Consumer Sentiment Index is a measure of consumer “sentiment” in the United States. Higher numbers suggest a more positive sentiment, lower numbers suggest a more negative sentiment.

Investopedia notes the following regarding the University of Michigan Consumer Sentiment Index:

“Consumer sentiment is a statistical measurement of the overall health of the economy as determined by consumer opinion. It takes into account people's feelings toward their current financial health, the health of the economy in the short term, and the prospects for longer-term economic growth, and is widely considered to be a useful economic indicator.”

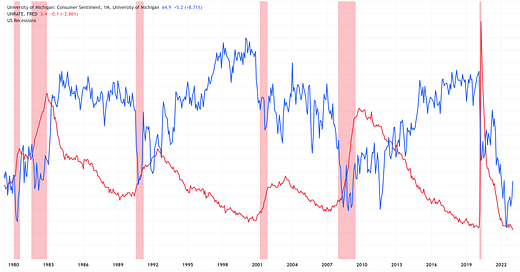

The chart below shows the University of Michigan Consumer Sentiment Index and the Unemployment Rate going back to the 1980’s (Note: the red vertical bars denote US recessionary periods).

Two observations:

Both metrics trend over time, but the University of Michigan Consumer Sentiment Index appears to be extremely noisy in the process.

There appears to be a negative correlation (i.e., when one goes up, the other one goes down) between the two metrics.

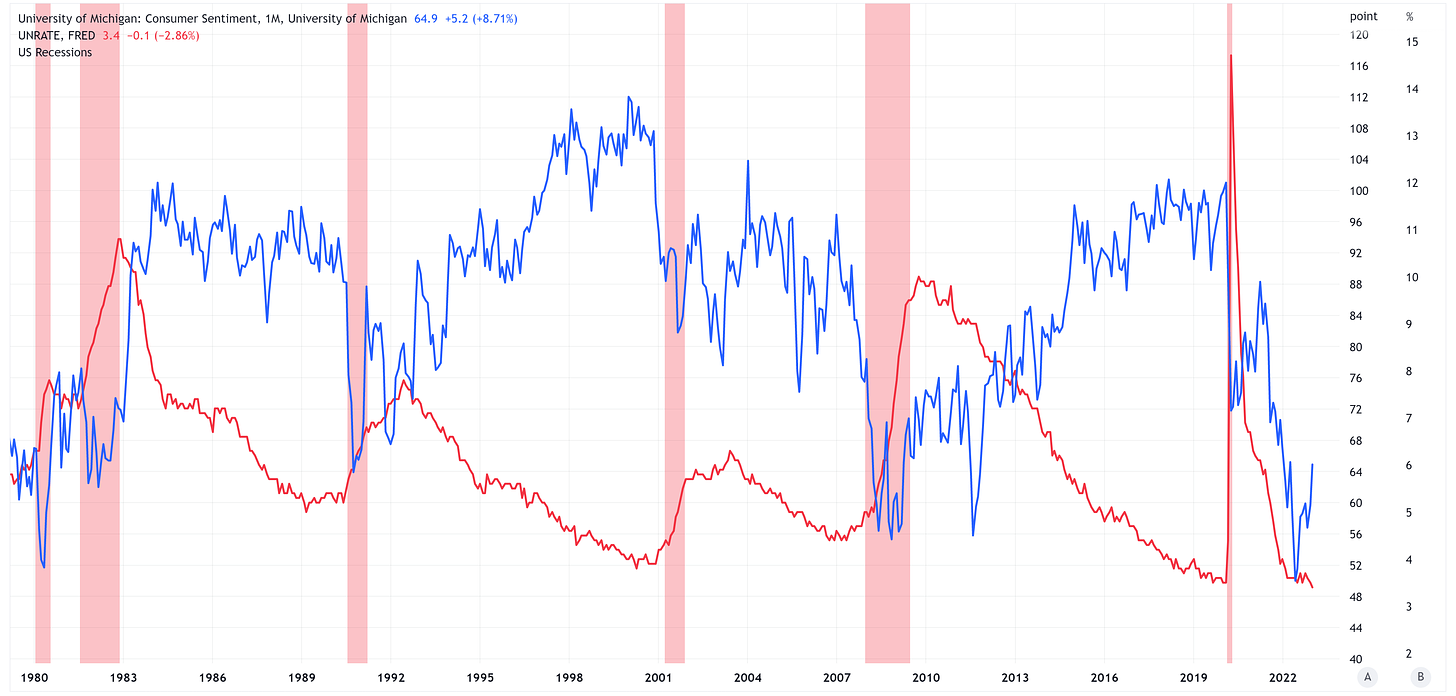

In order to strip out some of the “noise”, in the chart below, I am displaying the 24-month moving average for the University of Michigan Consumer Sentiment Index (blue line). Additionally, in order to visually observe if the two metrics are negatively correlated, I have inverted the values for the University of Michigan Consumer Sentiment Index.

When we do this, we find that while not a perfect match, they do tend to track one another quite nicely.

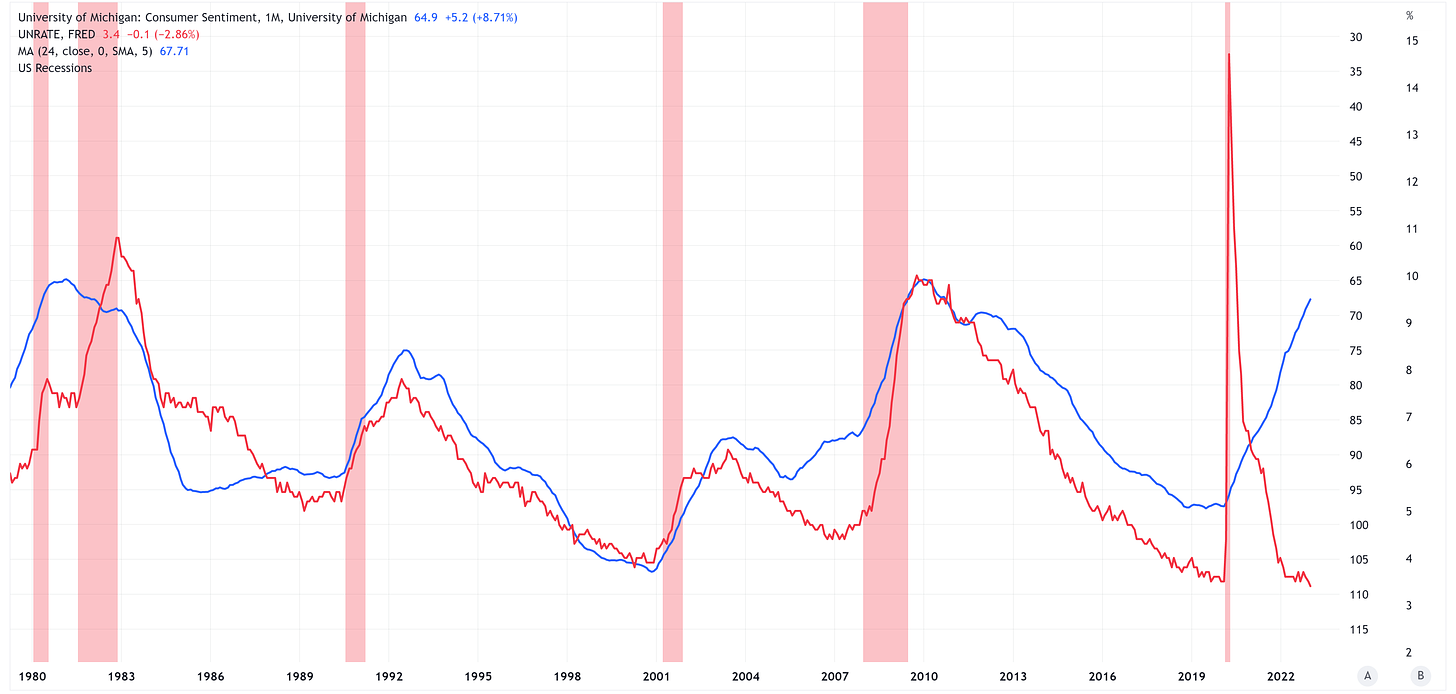

Because the two metrics tend to move in tandem with one another, this would suggest that they are “coincident” in nature. However, there are a few observations (green arrows in the chart below) where the University of Michigan Consumer Sentiment Index appears to be a “leading” indicator for the Unemployment Rate.

Looking at the most recent green arrow in the chart above…is the University of Michigan Consumer Sentiment Index suggesting that the Unemployment Rate is about to start trending higher?

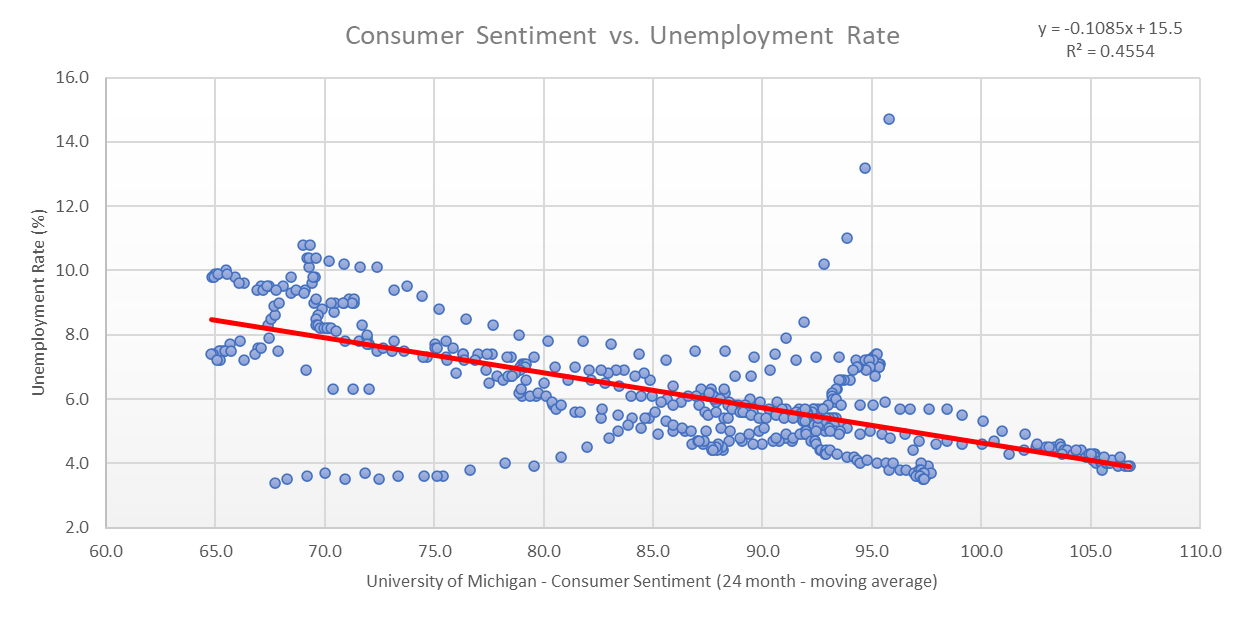

The chart below shows a scatter plot of the values from the previous charts. The downward sloping red line suggests that there is a negative correlation between the two metrics.

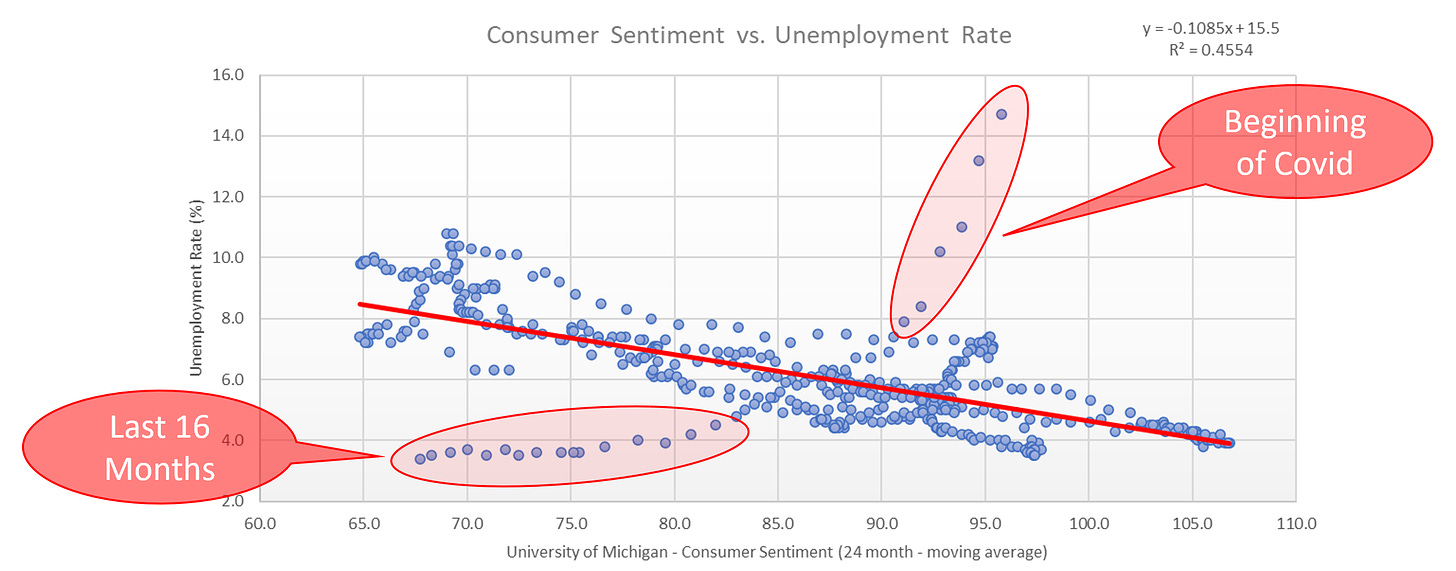

Another item of note from the chart above is that there appears to be two periods with outlying observations which I’ve highlighted in the chart below.

If we dive deeper into the origin of these anomalies, we find that one likely caused the other which is often the case when we see the pendulum swing from one extreme to another.

The first “distortion” is the result of the period immediately following the beginning of Covid where the Unemployment Rate spiked yet we didn’t see a huge drop-off in consumer sentiment.

Fast forward and we see the pendulum swing in the opposite direction as evidenced by the last 16 months. During this time, we’ve seen record low levels of unemployment despite the fact that “sentiment” in the US economy has begun to sour.

It’s not uncommon to see dramatic swings like this from one extreme to another until the market can get back to some sort of equilibrium.

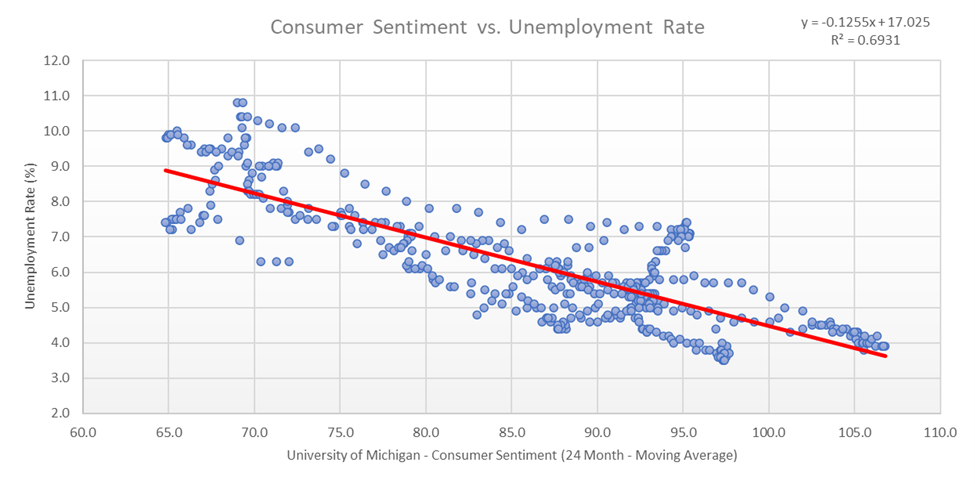

If we strip out these two outlier periods, we get the scatter plot below. Note that this scatter plot has an r-squared value of 0.6931 which is statistically very strong thus suggesting a fairly tight relationship between these two metrics.

The current value for the University of Michigan Consumer Sentiment Index – 24 Month Moving Average (67.3), would suggest that the current Unemployment Rate should be somewhere between 7.0% - 10.0%.

Why is this important?

I made the case in my piece, “Layoffs…What Are They Telling Us?”, that even the FOMC believes that the Unemployment Rate is going to move higher as they foreshadowed in their “Summary of Economic Projections” that was released in December.

How high will the Unemployment Rate go?

I don’t have any idea but as noted above, the current reading for the University of Michigan Consumer Sentiment Index – 24 Month Moving Average would suggest that the Unemployment Rate should be somewhere in the range of 7.0% - 10.0%.

Alternatively, what if, in the coming months, we see a dramatic improvement in the University of Michigan Consumer Sentiment Index – 24 Month Moving Average, somewhere directionally towards its long-term average of ~86? You can see from the chart above that a value of 86 has historically corresponded to an Unemployment Rate in the range of 5.0% - 7.0%.

Given that the Unemployment Rate is currently 3.4%, either way you slice it or dice it, the University of Michigan Consumer Sentiment Index would suggest that the Unemployment Rate “needs” to go higher. Is it going to 7.0% - 10.0%, I certainly hope not but the high end for the FOMC’s range of outcomes for 2023 is 5.3% so maybe the 5.0% - 7.0% range is at least within the realm of possibilities.

I made the following point in “Layoffs…What Are They Telling Us?”:

“Since the 1950’s, every time the unemployment rate had a sustained increase above its 12-month moving average, a recession has occurred.”

Which I followed by saying:

“The current unemployment rate is 3.4% and the current 12-month moving average is 3.59%. If the FOMC is even directionally correct in their assessment of where the unemployment rate is heading in 2023, and subsequent years, the unemployment rate will easily cross above its 12-month moving average and will likely be sustained there for a period of time.”

Not to be draconian, but the takeaway here is that we’re heading for a recession and the University of Michigan Consumer Sentiment Index is giving you advanced notice.

The question then becomes, “What should I do with this information?”.

I would remind you of this historical fact:

“If we look at history, we find that since the 1960’s, the S&P 500 has always made a new low once a recession began and the average decline from the start of a recession to the market trough is -29.2%. Further, if we look at this same time period, we find that the average decline from the first FOMC rate cut to the market trough is -27.7%.”

It’s not too late to prepare for this potential outcome.

Until next time…