The Federal Open Market Committee (FOMC) met January 31 – February 1. They concluded their two-day meeting by raising the Federal Funds rate by 0.25% to a range of 4.50% - 4.75%. In their press release, they included the following statement:

“The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

As of February 3rd, Federal Funds rate probabilities suggest that the most likely path forward (see blue shading in the table below) is for the FOMC to raise rates by another 0.25% at the March 2023 meeting and then hold rates steady before beginning to reduce rates at the November 2023 meeting.

These probabilities fluctuate on a daily basis and therefore should not be assumed to be predictive of the future; they are simply a reflection of what the market believes to be true today.

As of right now, we believe the February 1st rate hike will be the last rate hike in this current rate hiking campaign.

In the chart below, we have graphed the Federal Funds Effective Rate (blue line), the US Treasury 2-Year Yield (candles) and the 100-day moving average (orange line) for the US Treasury 2-Year Yield. Note: recessions are denoted by the green vertical shading.

Since the late 1980’s, each time the US Treasury 2-Year Yield fell below its 100-day moving average (red circle), the FOMC paused their rate hiking campaign. Worth noting that in 4 of the 5 instances, a recession followed shortly thereafter.

On January 12th, the US Treasury 2-Year Yield fell below its 100-day moving average and remains below the 100-day moving average as of this writing. We believe the US Treasury market (collectively, the “bond market”) is suggesting that the FOMC is done hiking rates.

Note: should the US Treasury 2-Year Yield rally above its 100-day moving average, and remain there, we would adjust our opinion to believe that more rate hikes could be possible.

The next logical question to ask is “Why would the bond market believe that the FOMC is done hiking rates?”, especially when the Fed Chair continues to suggest further rate hikes are needed and Fed Funds futures contracts are suggesting that there will be at least one more hike.

We believe there are two possible answers, one as perceived by the stock market, and one as perceived by the bond market.

1) The stock market believes that inflation will continue to decline and will allow the FOMC to declare “mission accomplished” in their fight against inflation which will be followed by the FOMC beginning to reduce rates.

2) The bond market believes the FOMC has already tightened too far and will likely incite a recession in the US economy by the end of this year.

Let’s discuss item #1 first:

We believe inflation will continue to decline in the subsequent months, but we do not believe the FOMC will use that as a catalyst to reduce rates. Fed Chairman Powell made the following statement during the Q&A portion of his press conference on February 1st:

“I continue to think that it is very difficult to manage the risk of doing too little, and finding out in six or 12 months that we actually were close but didn’t get the job done, and inflation springs back, and we have to go back in, and now you really do worry about expectations getting unanchored and that kind of thing. This is a very difficult risk to manage.

“Whereas, we have no incentive or desire to over-tighten, but if we feel we have gone too far, and inflation is coming down faster than we expect, we have tools that would work on that.

“So, I do think in this situation where we still have the highest inflation in 40 years, the job is not fully done.”

Our read-through on this statement leads us to believe that the FOMC would much rather err on the side of leaving rates too high for too long vs. reducing rates, only to have to reverse course again. This is exactly what happened in the 1970’s (see image below) and what the FOMC desperately wants to avoid.

Further, and logically thinking, if inflation did decline and the economy was still in good shape, what motivation would the FOMC have to reduce rates? Wouldn’t they prefer to have more available ammunition, in the form of rate cuts, to use for when the economy does start to decline?

With that said, we believe item #1 above is incorrect.

Turning to item #2:

We believe the stock market and bond market periodically have different views on the current economic outlook. These views tend to converge at some point, but there is often a period where they are different. We think this is one of those times.

It is often said that the stock market is a discounting mechanism looking forward by about six months. The S&P 500 returned 6.18% in the month of January and has returned 2.52% in the first two days of February. This does not appear to be a stock market that believes a recession is coming.

The stock market seems to be suggesting that the FOMC will be able to engineer a “soft landing” and that the US will be able to avoid a recession altogether. While this is possible, we believe it is unlikely and history tends to suggest otherwise, and we think the bond market realizes this.

The following quote is from Oaktree Capital, and we believe it is spot on:

“The history of the Fed suggests that it usually only shifts policy quickly in response to something bad, such as a credit crisis, economic downturn, severe market reaction, or, more recently, a global pandemic. The Fed is typically prone to keeping policy either too tight or too loose for too long.”

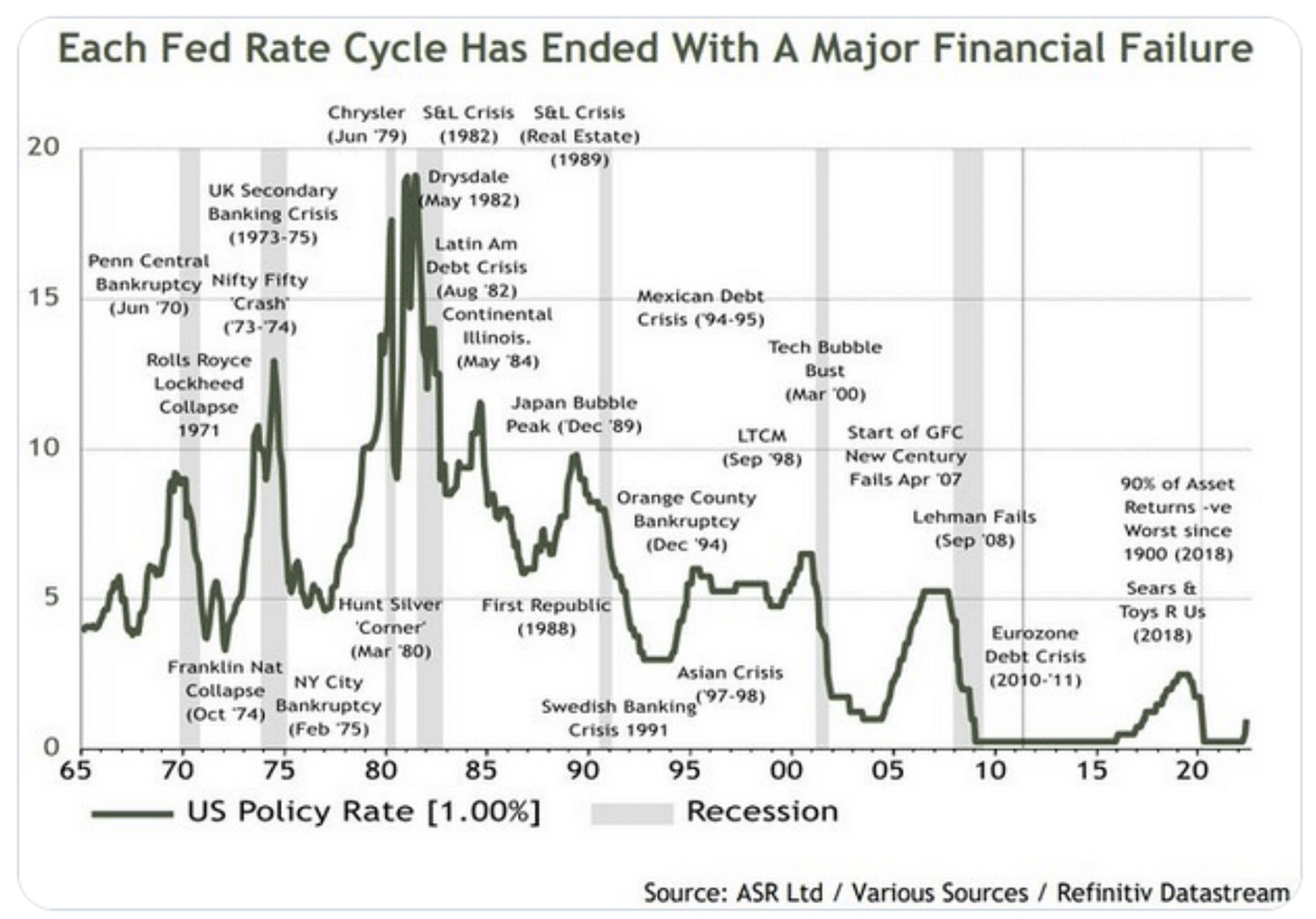

Typically, when the FOMC leaves rates too high for too long, “something breaks”. We never know in advance what it will be, but something typically breaks as evidenced by the chart below.

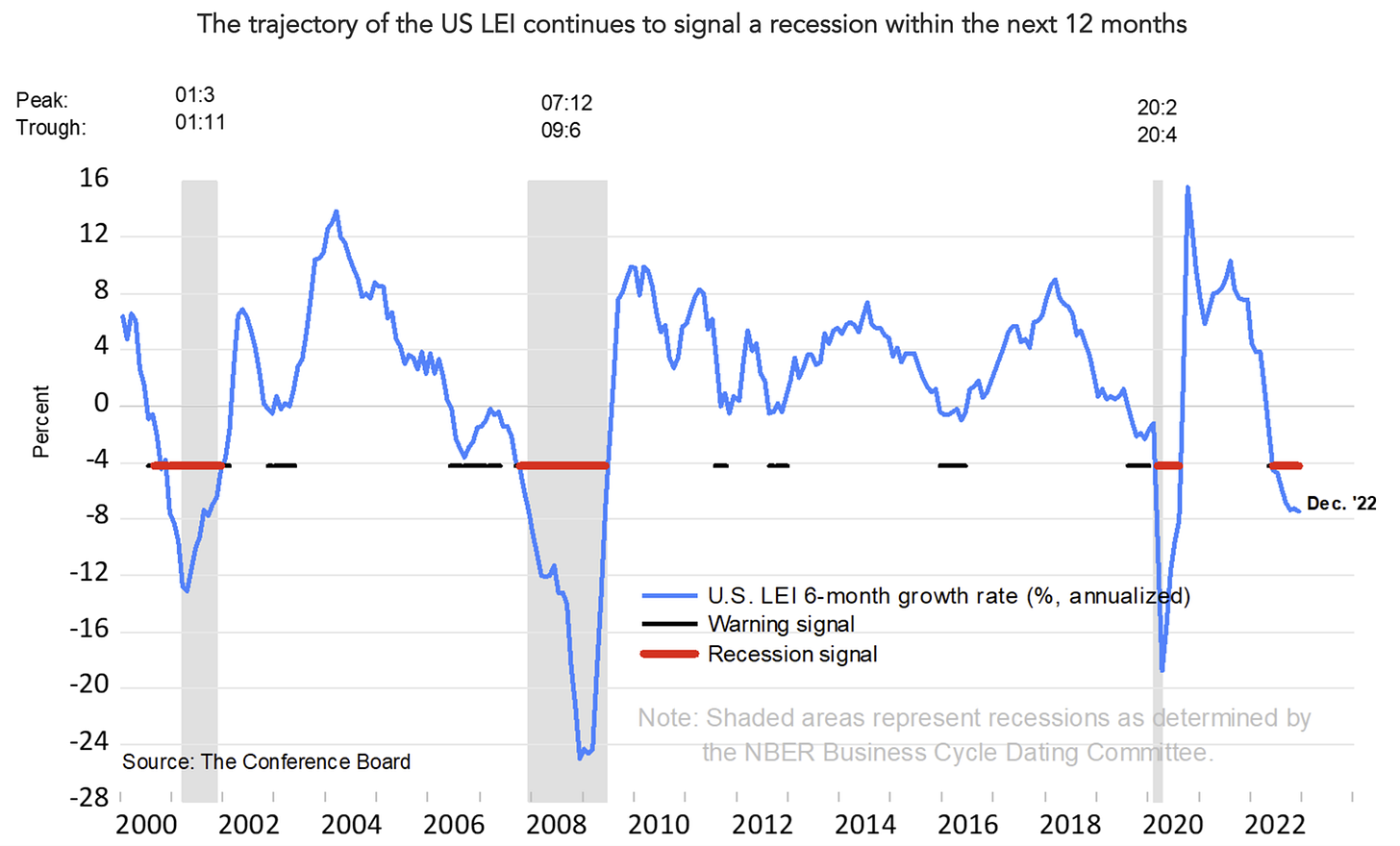

We believe the stock market is misreading the current economic environment and that there is a high likelihood of a recession beginning sometime in 2023 or early 2024. We could post a number of charts to support this thesis, but we believe The Conference Board Leading Economic Index (LEI) does a good job summarizing our point.

The chart below shows the US LEI 6-Month Growth Rate (%, annualized) and note that the current value has fallen below not only their “warning signal” but also below their “recession signal”. This tells us that leading economic indicators are pointing to a downturn in the US economy and as The Conference Board notes at the top of the chart “The trajectory of the US LEI continues to signal a recession within the next 12 months.”

If we look at history, we find that since the 1960’s, the S&P 500 has always made a new low once a recession began and the average decline from the start of a recession to the market trough is -29.2%. Further, if we look at this same time period, we find that the average decline from the first FOMC rate cut to the market trough is -27.7%.

This tells us two things:

1) The FOMC typically waits to cut rates until a recession is already upon us (i.e., they are late to the game).

2) History suggests that rate cuts are not typically associated with a market rally (i.e., which is what we believe the stock market wants to believe).

Jeremy Grantham recently posted the following chart as a gentle reminder of what can happen after rate cuts begin. He is specifically addressing periods after the stock market has entered what he calls a “superbubble”. For the record, he believes the US is currently in the midst of another “superbubble”.

Summary

So, what do we do with all of this? The stock market has started the year in an extremely strong manner and a lot of people are pointing to the old saying “As goes January, so goes the year…” If that remains true, 2023 should be a banner year for stocks given the 6.18% return in January. Alternatively, the bond market appears to be suggesting an entirely different outcome.

Which one is right, or could they both be? Is it possible that we have a really strong first half of the year only to have it fade in the second half of year? Anything is possible, the only thing we know for sure is that these crosscurrents feel somewhat irrational or at the very least at odds with one another.

This reminds us of the old John Maynard Keynes quote, which says:

"Markets can stay irrational longer than you can stay solvent."

To that end, we believe investors must remain diligent in assessing the current market and adjust their portfolios as needed. Instead of trying to predict the future (which is inherently very difficult), let the market tell you where it wants to go and then manage your portfolio accordingly.

We believe the market is headed for a recession (pro tip: the bond guys are usually right), but we could be completely wrong; therefore, you should never position your portfolio as though one outcome is a guarantee.

Instead, we believe you should assess the current trend of the market and position accordingly. This includes “getting out of the way” when the market decides to go south. Many people will say: “Just stay invested, the market always comes back…” While that may be true, we believe it is better to at least give yourself the possibility of not experiencing the full brunt of the market downturn while still having the ability to participate in the upside.

Our goal is to provide investors with the knowledge that they need to make better, more well-informed decisions that will help them navigate whatever lies ahead.

Until next time.