Let me start by wishing everyone a Happy Thanksgiving!

I hope you will spend some time this week counting the many blessings you have and thinking of ways you can use them to bless others. I believe that is what we are called to do.

Last week, I made the following suggestion:

“Unless you can make a convincing argument as to why US Equities are going to immediately turn South, the medium-to-long-term trend is suggesting a continued move higher.”

Scroll down to our “Asset Class Review” section, specifically the US Equities section, and you’ll note that US equities had a great week last week, especially some of the small and mid-cap names.

Further, take a quick look to the right under our “Trend - Composite” section and you’ll notice that 18 of the 25 US equities we track are currently “Max Bullish”.

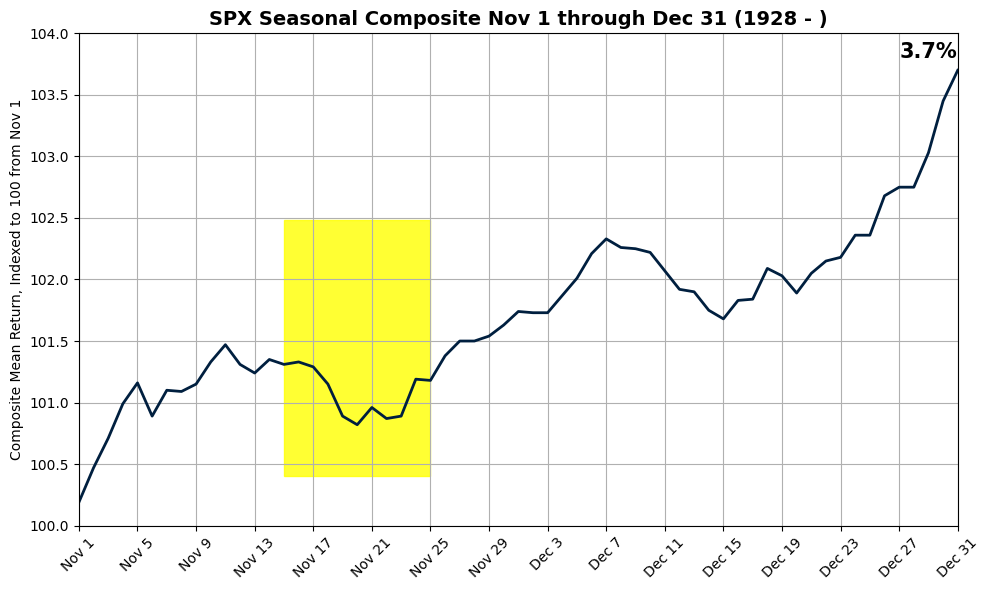

Goldman put out the following chart last week which speaks to the seasonal tailwind that this portion of the year typically has for the S&P 500.

Of course, past performance does not equate to future results but it certainly seems to skew towards a positive tailwind to close out the year.

I’ve posted the following chart a couple of times over the last few weeks and again, it continues to suggest a push higher over the short-term.

That was the good news, now the counter-balance.

Keep reading with a 7-day free trial

Subscribe to Skillman Grove Research to keep reading this post and get 7 days of free access to the full post archives.