Last week's big event was the FOMC meeting which concluded on Wednesday, March 20th. The FOMC left rates unchanged at 5.25% - 5.50% which was a foregone conclusion and thus not a surprise. If there was a “surprise”, it was in J. Powell’s forward guidance relative to the published economic projections.

Coming into the meeting, if you had asked me what I thought the Fed was going to do, I would have said something along the lines of:

“I bet they leave rates unchanged, acknowledge that the last two inflation reports came in ‘hotter than expected’ and becuase of that, they may need a little more time before giving the ‘all clear’ to begin cuting rates. So instead of the market pricing in three rate cuts in 2024, I bet the market moves directionally toward pricing in only one or two rate cuts at most…”

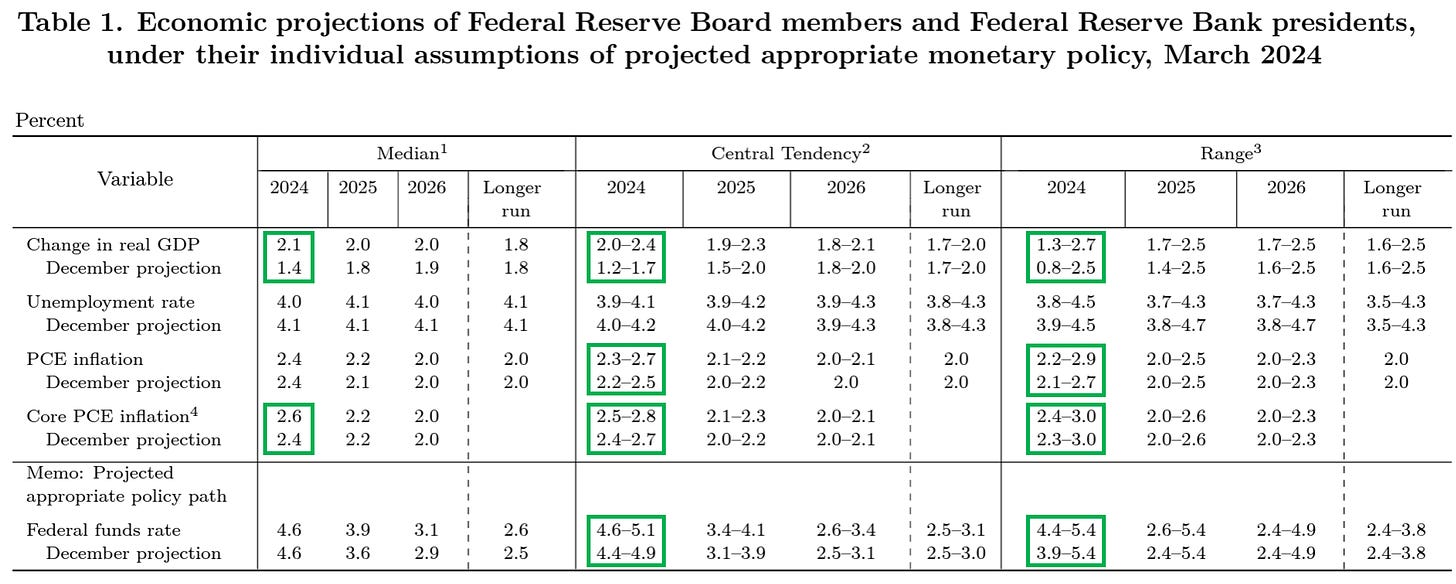

Here are the published “Economic Projections” that were released on Wednesday with the FOMC’s decision.

So let me get this straight…the FOMC is now forecasting, relative to their previous forecast in December, that:

GDP is going to be stronger than previously expected

PCE inflation is going to be hotter than previously expected (central tendency & range)

Core PCE inflation is going to be hotter than previously expected

Fed Funds rate is going to be higher than previous expected (central tendency & range)

And yet, despite all of these “improvements” and “hotter than expected” outcomes, the Fed still believes they are going to cut rates three times this year?

Let me be clear, I’m not suggesting that these “improvements” and “hotter than expected” outcomes warrant a rate hike, but I certainly don’t see how they translate to three rate cuts in 2024.

I said it several newsletters ago, and I’m sticking by it, short of a catastrophe, I don’t see the Fed cutting rates at all in 2024.

At some point, the equity market will wake up to the this reality and I don’t think that will translate to positive short-term outcomes for the markets.

But until then, we have to play the hand we have been dealt so let’s check in on our S&P 500 and NASDAQ “cup and handle” charts and our current market targets.

Keep reading with a 7-day free trial

Subscribe to Skillman Grove Research to keep reading this post and get 7 days of free access to the full post archives.