Weekly Chart Review

We are not guaranteed tomorrow...

As I sat down to type this week’s newsletter, our family learned of the passing of the son of some dear friends in our neighborhood. He was 19.

For the last several years, he had struggled with kidney problems but recently had a kidney transplant and was making significant progress, and we all thought he was on the mend.

We are not guaranteed tomorrow.

How many things that you’re worried about right now would matter if you knew this was your last week on this Earth? My guess is not many.

However, the things that would matter the most would be your faith, your family, and your friends. Prioritize those things in your life and in that order.

My heart is grieved for this family and for my kids as they begin to process for the first time what it’s like to lose someone so close and so young.

Given everything above, I don’t have it in me to write this week and I apologize for that.

I will leave you with our weekly review of the various asset classes and a few charts.

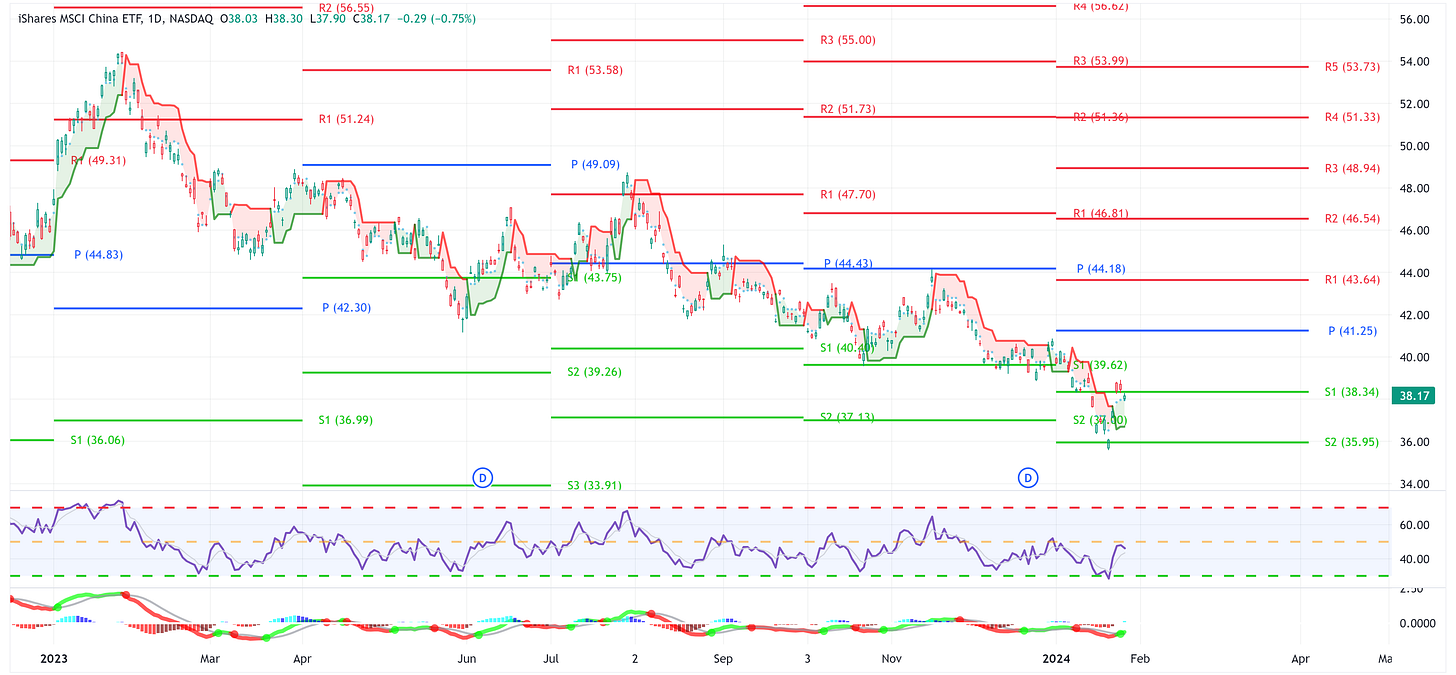

Watch EWH - Hong Kong and MCHI - China as they both turned positive on the “Daily” trend from fairly deeply oversold conditions the previous week (i.e. Z-Scores of -1.72 and -2.15, respectively). Could this be the turn higher? See the charts below.

Overview

US Equities

International Equities

Emerging Market Equities

Fixed Income

Commodities

Currencies

EWH - Hong Kong

If EWH can clear the quarterly S1 pivot (16.30), the next line in the sand is the quarterly pivot (16.92).

MCHI - China

If MCHI can clear the quarterly S1 pivot (38.34), the next line in the sand is the quarterly pivot (41.25).

S&P 500

Still making the move higher towards the 5,722 target.

NASDAQ 100

Still making the move higher towards the 21,423 target.

US 10 Year

Watch for resistance around 4.22%.

Hug your spouse and kids…tell them you love them and never take for granted this day that the Lord has given us.

Condolences.

Kent