This week we’re going to dive into the quarterly update of my favorite chart, the “Average Investor Allocation to Equities” chart.

I consider this to be one of the more important updates that I do periodically given degree to which the “Average Investor Allocation to Equities” chart has predictive characteristics for the future returns of US equities.

Given the importance of this week’s piece, I have decided to share this week’s newsletter, in its entirety, with all of our subscribers (both free subscribers and paid subscribers). I will note in advance, this week’s newsletter will be a little longer than most.

My hope is that if you find value in this newsletter:

You will consider becoming a paid subscriber.

You will consider sharing this newsletter with a friend or colleague.

As a token of my appreciation and gratitude for everyone’s support, I am providing a 15% annual discount to anyone who signs up to become a paid subscriber using the link below.

The 15% annual discount equates to less than $1 a day for institutional quality research and a different perspective than what you’ll find from the “big box” shops.

With that out of the way, let’s jump into this week’s newsletter.

Average Investor Allocation to Equities

Let’s start with the chart and then get into the analysis and takeaways.

Here is a definition:

“The blue line in the chart shows the “Average Investor Allocation to Equities”. As the name would imply, this line shows how much (i.e., what percentage) of the average investor’s portfolio is allocated to equities at any given time as opposed to other asset classes (i.e., fixed income, commodities, cash, etc.) This line maps to the left-hand scale of the chart.

The yellow line in the chart shows the “10-Year Forward Annualized Price Return” of the S&P 500 Index. This tells us what the 10-year forward return was for the S&P 500 Index from the corresponding point on the blue line. This line maps to the right-hand scale of the chart and the values have been inverted to better show the relationship between the two metrics.”

Next, we want to understand how to interpret this chart:

“Very simply, the higher the blue line (i.e., the “Average Investor Allocation to Equities”), the lower the subsequent 10-year return for the S&P 500 Index and vice versa.”

Scatterplot

If we create a scatterplot using the values from the chart above, we get the following chart. Note the R-squared value of 0.7806 in the top right-hand corner.

Further, if we take the most recent value for the Average Investor Allocation to Equities (48.26%) and plot it on the chart above using the regression formula generated in the top right-hand corner of the chart, we find that a current value of 48.26% equates to an annualized return of -1.19% for the S&P 500 over the next 10 years.

It is important to remember that this does not suggest that the S&P 500 is going to return -1.19% each year for the next 10 years. Instead, it suggests that over the next 10 years, the annualized return over that entire 10-year period will be somewhere in the ballpark of -1.19%.

This likely means that we will have a recession or two over that 10-year period which will be accompanied by outsized drawdowns followed by outsized rallies all of which culminating in a 10-year annualized return of somewhere in the neighborhood of -1.19%.

Taking it a step further

The following chart is the same as the first one above, but I’ve broken it down into three different segments.

The first two segments represent a full cycle (i.e. trough-peak-trough) for the Average Investor Allocation to Equities.

The third segment is the current cycle which has yet to be completed.

Note in the chart above that I have used green/red arrows to denote up/down trends for the Average Investor Allocation to Equities.

Here is what those same periods (green/red arrows) look like when we chart the S&P 500. Note: the grey vertical bars represent US recessions.

A couple quick observations:

During the “green arrow” periods, you can pretty much close your eyes, go long the S&P 500, and you will fare quite well.

The “red arrow” periods are a bit more challenging and are typically accompanied by dramatic sell-offs followed by equally dramatic rallies but ultimately ending with a sideways or negative return.

Further, we notice that:

Once the “red arrow” period begins, the first sell-off is followed by a rally that overshoots the previous high. However, the second sell-off typically overshoots the low of the first sell-off.

Looking at our current situation:

We’ve had the first sell-off of the “red arrow” period (2022).

The current rally has eclipsed the previous high.

This would suggest that the next sell-off will go further than the low of the first sell-off in this “red arrow” period which was 3,492 or a -32% decline from Friday’s close.

S&P 500 - Fair Value

Given the tightness of the historical fit between the two lines in the original chart above, we can use this relationship to create a “fair value” line for the S&P 500 through time and over the next 10 years. That is what I have done in the chart below.

A few quick definitions:

Blue line = S&P 500 actual price

Red line = S&P 500 “fair value” price

Grey histogram = Z-Score (standard deviation) of the difference between the S&P 500 actual price and the S&P 500 “fair value” price.

A few observations:

The S&P 500 “fair value” is generally upward sloping through time.

The S&P 500 often extends well-beyond its “fair value” (both positively and negatively), but it always comes back to “fair value” at some point.

During the recessions of 2001 and 2007-2009, the S&P 500 fell all the way to the “fair value” line and beyond.

During the correction of 2018 and the recession of 2020, the S&P 500 fell almost exactly to the “fair value” line before stopping and reversing course.

The one similarity between all of the above examples is that the downturn didn’t end until the Z-Score fell to somewhere between -3.0 & -4.0 (see orange arrows). Note: the current Z-Score is +2.07.

The key difference is the speed of the downturn.

A sharp/quick downturn (i.e., 2018 or 2020) is usually met with a central bank that is more likely to act quickly and thus the decline tends to stop at or near the “fair value” line.

A slower or more prolonged downturn (i.e., 2001 & 2007-2008) tends to have a greater chance of moving below the “fair value” line before reversing.

The S&P 500 would have to fall by -49.6% to reach its current “fair value” line.

Where does this leave us?

Given everything I’ve noted above, let’s take a minute to level set where we are in the current market environment.

The Average Investor Allocation to Equities peaked on 12/31/2021 at 51.3%.

This concluded the most recent “green arrow” period which would suggest that we are now in a “red arrow” period.

“Red arrow” periods are characterized by increased volatility and flat to negative returns over the remainder of the cycle.

The S&P 500 “fair value” model suggests that the current “fair value” for the S&P 500 is 2,577.23 which equates to a decline of -49.6% from Friday’s close.

This suggests that the next downturn will stop at the fair value line (i.e. similar to 2018 & 2020) but dissimilar to 2001 & 2007-2009 where the S&P 500 fell below the “fair value” line.

The Conundrum

Despite all of the “negative” commentary noted above, the market continues to rally.

This leads to two likely questions:

Do we have any sense as to when the current rally may stop?

How do we safely stay invested so that we don’t miss out on the rally while at the same time protecting ourselves from a bigger downturn?

Let’s start with the first question.

Do we have any sense as to when the current rally may stop?

The honest answer is that I have no idea when the current rally is going to stop, nor does anyone else.

However, I saw a fascinating chart by Trahan Macro Research last week which I have provided below.

The chart looks at the relationship between the yield curve (specifically UST 10 year - UST 2 year) and CBOE Volatility Index (VIX).

What they have found is that if you invert the yield curve (UST 10 year - UST 2 year) and advance it by 27 months, it gives you a pretty good indication as to when you should expect to see an increase in equity volatility or the VIX. The chart would suggest that the time is quickly approaching.

Why does this matter? It matters because the S&P 500 and the VIX tend to be negatively correlated. Said differently, when the VIX increases (which is what Trahan’s charts are suggesting could happen soon), the S&P 500 decreases.

Here is a scatterplot of the monthly price changes for the VIX (x-axis) vs. the S&P 500 (y-axis). Note the downward sloping line (i.e., negative correlation).

We don’t know when the next downturn will start but Trahan’s research makes a pretty compelling case that it could happen sooner rather than later. Further, given that we’re in a “red arrow” period, every decline should be looked at through the lens of “could this be the beginning of the decline that takes us back to ‘fair value’”?

Now, let’s tackle the second question.

How do we safely stay invested so that we don’t miss out on the rally while at the same time protecting ourselves from a bigger downturn?

Similar to the first question, just as we don’t know when the next large correction will begin, we also don’t know how far the market can run in this current rally.

Regular readers know that each week we try to take a look at the markets, make a call on where the markets could go but at the same time, be honest enough with ourselves to admit when we may have been wrong and then adjust accordingly.

More recently, we have focused our attention on the “cup and handle” technical pattern that has formed on the S&P 500 and the NASDAQ to get a sense for how high each of these markets may go.

If we take a quick look at how things ended last week, here’s how things are shaping up.

S&P 500

We have been calling for a target price of 5,725 on the S&P 500. This target remains in place, but it is worth pointing out that the RSI and MACD appear to running out of steam and look like they are in the early stages of starting to turn lower.

It is certainly possible that the S&P 500 will have a modest correction over the next several weeks. I can see a scenario whereby the S&P 500 trades down to its weekly trailing stop loss (green line in the chart below) and then reignites the bull run towards the target of 5,725.

With that said, we need to be cognizant of a greater correction which would negate the target outlined above. In the charts below, working from left to right, I am showing the daily, weekly, and monthly charts for the S&P 500 with their respective time frame trailing stop losses.

Allow these levels, in their respective time frames, to be warning signals.

Daily = 5,078

Weekly = 4,919

Monthly = 4,559

The longer the time frame, the greater the significance of a break of the levels noted above.

For instance, if 5,078 on the daily chart is broken, we probably won’t like it but it’s not the end of the world as it’s only a decline of -0.76% from Friday’s close.

Similarly, a break of 4,919 on the weekly chart would be a decline of -3.87% from Friday’s close. Again, not the end of the world.

Lastly, a break of 4,559 on the monthly chart would be a decline of -10.90%. A -10% correction in the midst of a longer-term bull run is completely normal; however, there comes a point where you have to start to wonder if a decline of more than -10% is the start of something bigger.

NASDAQ

If we go through the same analysis for the NASDAQ, we find that our target remains 21,423 but technically speaking, the NASDAQ is in a little worse shape than the S&P 500.

Note that the RSI on the NASDAQ has already broken down and through the 70 level and that Friday’s close put the NASDAQ below the daily trailing stop loss.

Here are the levels, in their respective time frames, which can be used as warning signals for the NASDAQ.

Daily = 17,865 (already broken)

Weekly = 17,240

Monthly = 15,423

Again, it’s completely possible to have the NASDAQ trade down to its weekly (or even monthly) stop loss and then resume the bull run, but we’ve reached the point of needing to make sure we have our antenna up for a possible bigger move lower.

To summarize everything above, we continue to be in a massive bull run, but we need to keep an eye towards a larger move lower given that we are in a “red arrow” period and the significant drawdowns that could come from said “red arrow” period.

Now let’s turn to our weekly asset class review.

Asset Class Review

Each week we take a spin through the major asset classes in an attempt to discern a) what has changed, b) how markets are tilted (i.e., “Bullish” or “Bearish”), and c) where markets may be extended (either positively or negatively) which may provide an opportunity to either enter or exit a position. We do this by looking at three different time periods: Daily, Weekly, and Monthly.

Overview - Weekly Changes

The biggest change we saw last week was in the more heavily weighted “Bearish” move on the Daily charts. Note that 24% of ETFs that we track turned “Bearish” whereas only 7% turned “Bullish”. This move was more heavily weighted towards the Fixed Income complex with the move higher in rates last week.

Overview - Totals

Despite the more “Bearish” move on a week-over-week basis, as you can see below, we still remain skewed “Bullish” overall across all three time periods.

US Equities

Note that QQQ and MTUM both turned “Bearish” last week on the Daily charts. Is this the start of a modest correction or just a one-off week?

International Equities

The changes last week for International Equities were only in the “Bearish” direction.

Emerging Market Equities

Emerging Markets were a bit more balanced last week with 28% turning “Bullish” and 22% turning “Bearish” on the Daily charts.

Fixed Income

Note the “Bearish” move across the US Treasury curve from 1-3 years all the way to 25+ years on the Daily charts.

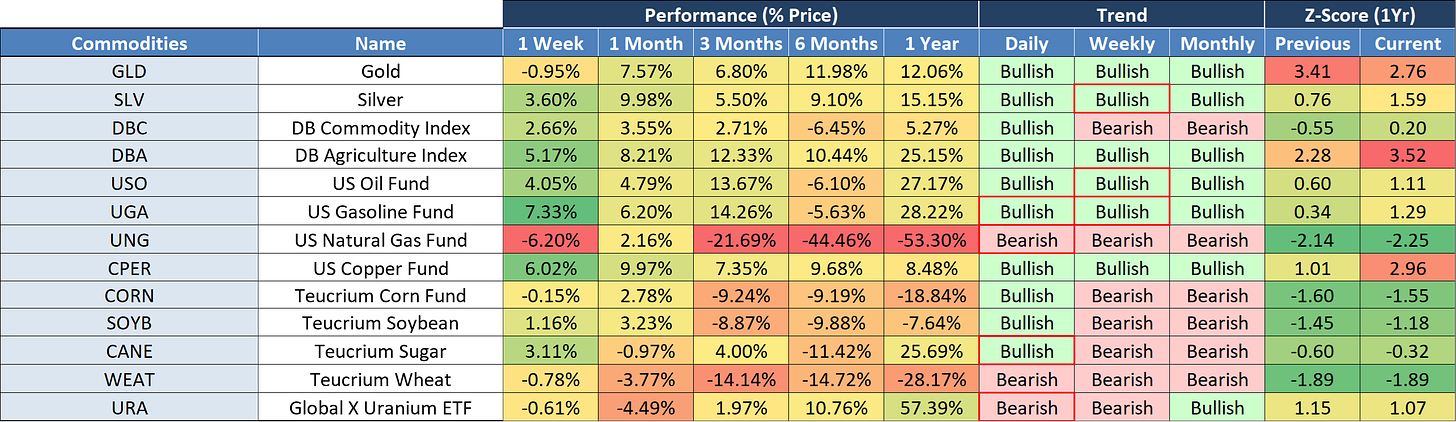

Commodities

If there was a pocket of strength last week, it was in the Commodities complex. Note the 1 Week price changes across the board. This is likely directly related to both CPI and PPI coming in hotter than expected last week.

Currencies

The Japanese Yen and Swiss Franc took a “Bearish” turn last week on the Daily charts. Bitcoin finished positive for the week but began to selloff over the weekend thus flipping the Daily chart to “Bearish”.

Thank you, as always, for your support of this newsletter!

If you have found it helpful, please consider becoming a paid subscriber and feel free to share it with a friend or colleague.

Let’s make it a great week!

Amazing analysis! Love the historic dive into long term trends. And it takes wisdom and humility to hold apparently contradictory views that we may have entered a period of heightened, dramatic downside risk and yet there could be another 10% upside (or more!) before things fall apart.

Email me directly and I’ll send it to you. Just reply to the weekly update and I’ll get it.