As I type this week’s piece, headlines are hitting the wires indicating that President Biden has suspended his reelection campaign and endorsed Vice President Kamala Harris to replace him as the nominee.

Over the last couple of weeks, this became a more likely outcome so while not a great surprise, it should give markets more clarity on the path forward (assuming Vice President Harris does become the nominee).

Last Week

Last week was a tough week for the US equity market as the S&P 500 declined by -1.97% and the NASDAQ 100 declined by -3.98%.

It was also a tough week for equities in general (i.e., US, international, emerging markets, etc.) and commodities.

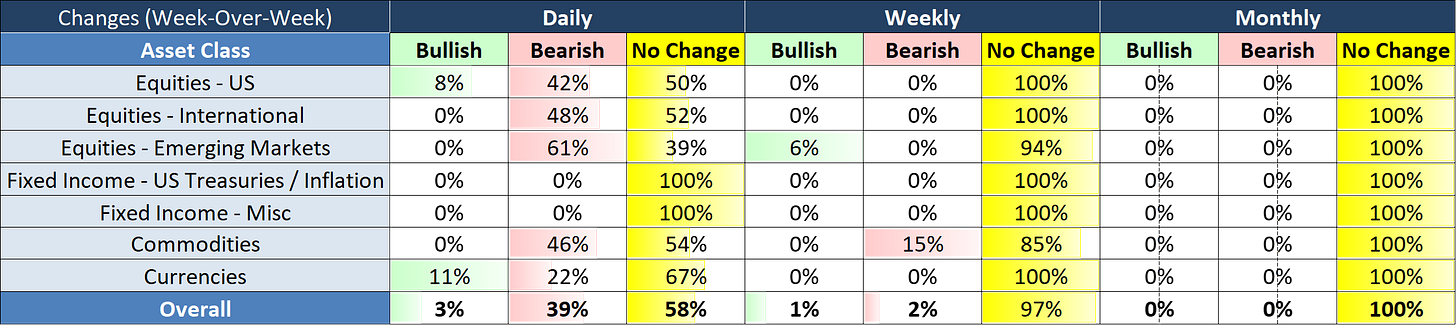

You can see this in greater detail by scrolling down to the “Weekly Changes” within our “Asset Class Review” and focusing on the “Daily” column (copy/pasted below).

Note the high degree of “Bearish” changes on the Daily time frame last week.

With that said, note that not one of the equities we track triggered a “Bearish” change on the Weekly or Monthly time frames.

If history is a guide, typically, larger, more pronounced sell-offs begin to show themselves on the Daily time frame, then cascade into the Weekly time frame and ultimately the Monthly time frame.

So far, this would only register as a very minor correction (if that) but we do want to pay attention if last week’s selloff extends into this week and beyond.

Here is a quick check on our “line in the sand” for the S&P 500 and NASDAQ 100 on the Weekly (left) and Monthly (right) charts. Recall, these are the specific levels where we can arguably say “We might be on the cusp of a bigger selloff…”

Keep reading with a 7-day free trial

Subscribe to Skillman Grove Research to keep reading this post and get 7 days of free access to the full post archives.