Weekly Chart Review

Risk / Reward

Regular readers know I attempt to take a fairly pragmatic approach to analyzing markets. If the markets and the macro environment are overly extended, I will point that out and suggest you may want to proceed with caution. The opposite is also true.

Historically speaking, markets have spent more time moving higher than moving lower. This makes intuitive sense as humans and technology continue to advance, we should theoretically continue to improve and get more efficient as we discover and create new things. This leads to new and better businesses and investment opportunities which propel the markets higher.

All else being equal, this would suggest that you should skew towards being long the market. With that said, there are times when the most prudent thing to do is to take some risk off the table.

Recessions

The three most recent recessions had the following peak-to-trough drawdowns for the S&P 500:

2020 = -35.4%

2008 = -57.7%

2001 = -50.5%

2020 was a bit of an anomaly given the massive amounts of liquidity thrown at the economy, but typically, it takes time and a significant appreciation of asset values to overcome the market drawdown.

For instance, the math suggests that the previous three recessions required the following returns to get back to where you started:

2020 = -35.4% —> +54.8%

2008 = -57.7% —> +136.4%

2001 = -50.5% —> +102.0%

It also takes time. The chart below shows the amount of time needed to get back to your original starting point:

2020 = 26 weeks (or 0.5 years)

2008 = 286 weeks (or 5.5 years)

2001 = 381 weeks (or 7.3 years)

Fast Forward to Today

For the better part of the last 6-12 months, we have witnessed a market that continues to grind higher even as we get recessionary “warning signals” with increasing regularity (see last week’s newsletter here).

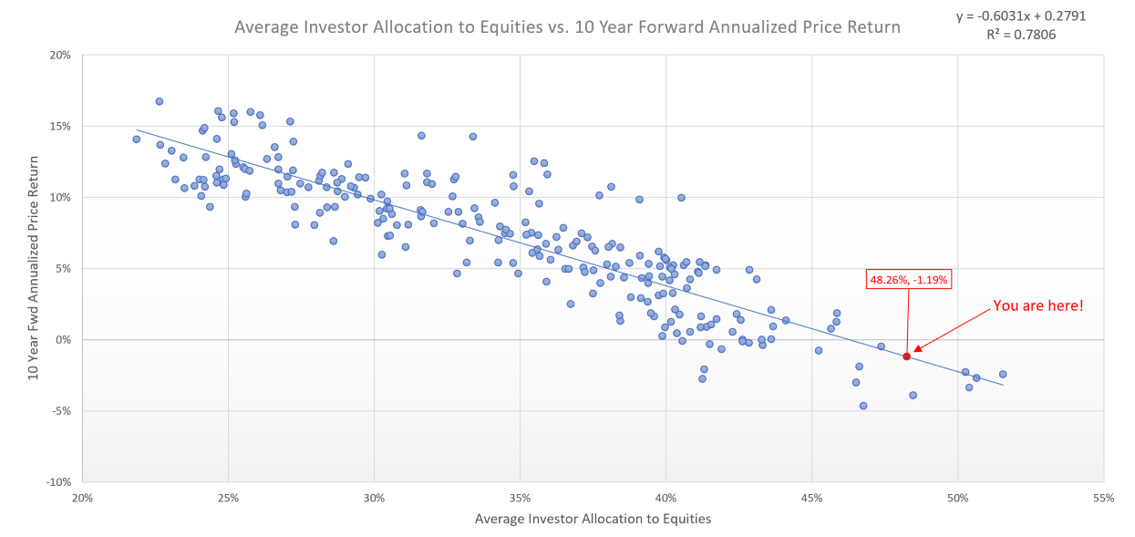

The market may continue to move higher from here; however, leveraging the work I’ve done with my “Average Investors Allocation to Equities” model (read more here), I would suggest that extended bull market runs typically do not begin from this point in the economic cycle.

That begs the question: “If the market can go higher from here, how high can it go?” The honest answer is that no one knows; however, we can use technical analysis to put some guardrails around potential outcomes. Let’s look at where the S&P 500 and NASDAQ could potentially go in the current environment.

Keep reading with a 7-day free trial

Subscribe to Skillman Grove Research to keep reading this post and get 7 days of free access to the full post archives.