Weekly Chart Review

Quick Note + 15% Discount for Life!

I had family in town all weekend so this week’s newsletter will be shorter than usual.

With that said, I’d like to do a couple of things this week that I don’t usually do.

First, I will remove the paywall so that all readers can access the “Asset Class Review” and the “S&P 500 Fair Value Model” which are behind the paywall each week.

Note: I’ll do a deeper dive below discussing each of these weekly features.

Second, I will offer a 15% discount to any new subscribers that subscribe this week. Regular readers know that I very rarely offer discounted subscriptions and this will only run through this weekend.

Note: Click on the button below to get the discount. This discount equates to less than a dollar a day for research that you will not find anywhere else, and certainly not from the “big box” shops.

A couple of charts before we discuss the Asset Class Review and the S&P 500 Fair Value Model.

S&P 500 -

The S&P 500 remains “Max Bullish” in our “Asset Class Review” model and seemingly has plenty of room left to run with resistance not until 5,886 and then again at 5,980.

NASDAQ -

Very similar story for the NASDAQ as it remains “Max Bullish” in our “Asset Class Review” model and does not run into resistance until 20,756 and then again at 21,356.

Asset Class Review

The “Asset Class Review” is designed to give readers/investors a quick look at the various asset classes we track each week (103 in total). These are the ETFs that many investors/advisors use to create portfolios.

The goal is threefold:

Provide a gauge of recent performance (i.e., weekly, monthly, quarterly, semi-annually, and annually).

Provide a gauge of trend over three time periods: short (daily), medium (weekly), and long (monthly) term.

Provide a gauge of overbought and/or oversold which we do using the Z-Score.

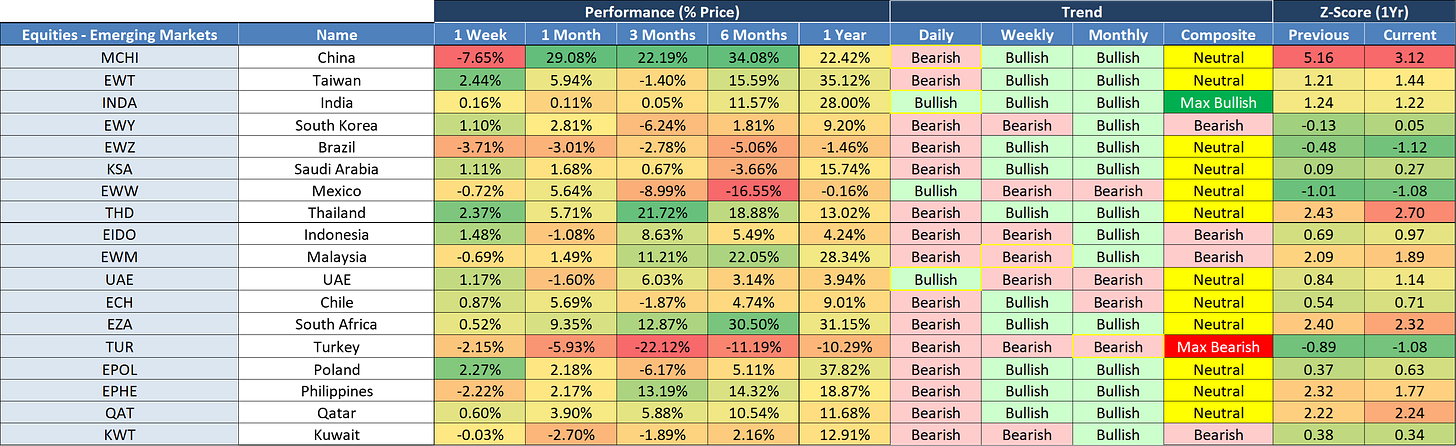

Let’s walk through an example from this week’s Asset Class Review (see below). We’ll do this by looking at Hong Kong (EWH) and China (MCHI).

The first thing you should notice is that both their respective Z-Scores are color-coded in bright red. This suggests that they are overbought.

Next, note that the Daily trend shifted from “Bullish” to “Bearish” last week. The yellow box around “Bearish” in the Daily trend column signifies the change from the previous week.

Next, notice the strong performance over the previous 1, 3, and 6-month time periods which was followed by poor performance last week.

Adding it all up, we can see that a) EWH and MCHI are extremely overbought, b) their “composite” trend has shifted from “Max Bullish” to “Neutral”, and c) recent performance is turning lower.

Does this mean that you should take action immediately? No, but what it does mean is that this should grab your attention and make you dig deeper into why these assets are seemingly “making the turn” lower.

China has provided a lot of stimulus to their economy in recent weeks. Some have suggested that more stimulus is needed. Is the market selling off to reflect this perceived need for more stimulus? If so, how does the Chinese government respond? Will they provide more stimulus? If not, does the market continue moving lower?

These are open questions and I don’t have all of the answers, but if nothing else, this model should be used to systematically generate questions that could lead to better investment decisions.

Weekly Changes

Overall Totals

US Equities

International Equities

Emerging Market Equities

Fixed Income

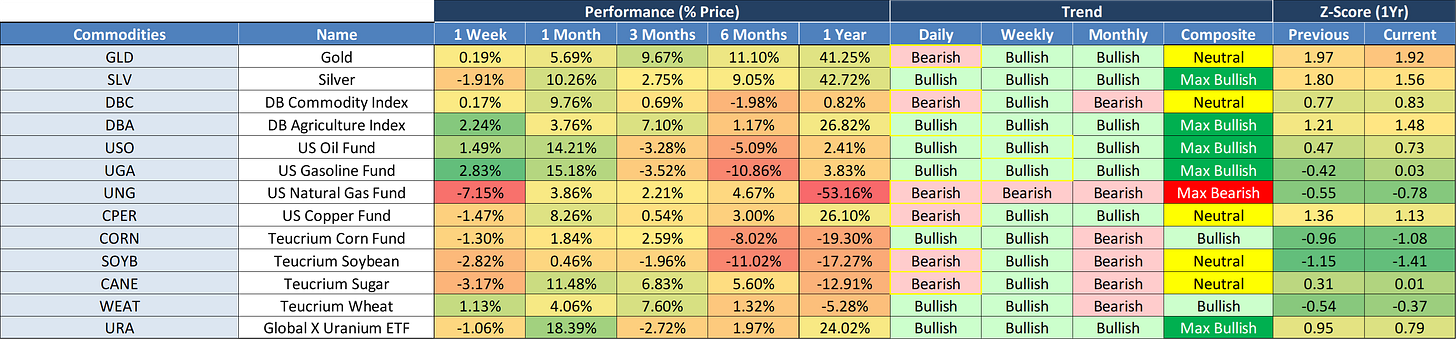

Commodities

Currencies

S&P 500 - Fair Value

I close out each week with my S&P 500 - Fair Value model. For a deeper dive into the construction of this model, go here.

The goal is to provide an unbiased, systematic fair value price for the S&P 500. No opinions, no guesses, etc., just math.

In addition to the fair value price, each week I provide a “Current Z-Score Value” which tells us, in standard deviation terms, how far the current S&P 500 price is above/below its fair value price.

For example, the S&P 500 closed Friday at 5,815.03. The current model-based “fair value” for the S&P 500 is 2,641.56 which suggests that the S&P 500 would need to fall by -54.6% from its current value to reach its fair value.

Does this mean that the decline is going to begin this week, this month, or this year, absolutely not, but what it does mean, and history proves, is that at some point, the S&P 500 will correct back down to this line.

Using our Asset Class Review model, you can see that the S&P 500 currently has a “Max Bullish” rating so that tells me that we are not in jeopardy of “making the turn” lower in the short-to-medium term.

However, what it does suggest, is that when we do “make the turn”, we should expect the S&P 500 to lose approximately half of its value.

The other benefit of this model is that it gives us a very good mechanism for determining when the sell-off (i.e., the aforementioned ~50% decline) has subsided and it may be safe to get back in the water. This will become a very valuable tool over the next couple of years as I believe the sell-off that is coming will create a generational buying opportunity.

Thank you, as always, for your support of this newsletter and never hesitate to reach out if you have any questions!

If you have found it helpful, please feel free to “like” it and share it with a friend or colleague, and don’t forget to take advantage of the 15% discount for life!

Let’s make it a great week!

Take care,

Jim Colquitt