Weekly Chart Review

FOMC + Unemployment Rate

This week we have two key economic releases that will help shape the forward trajectory of the market.

FOMC

The first is the FOMC rate decision on Wednesday.

As it stands today, there is a greater than 95% chance the Fed will leave rates unchanged at their meeting this week.

For this to change over the course of the next 2.5 days, something would have to go catastrophically wrong so I can say with a high degree of certainty, that the Fed will not cut rates at this week’s meeting.

This means that the next chance the Fed has to cut rates is at the September 18th meeting.

Recall, that the September 18th meeting is the last meeting before the election on November 5th (the next FOMC meeting is not until November 7th).

I believe the Fed desires to cut rates before the election. Whether or not that is the prudent thing to do is another discussion, but I believe they want to cut before the election.

The market is currently pricing in an 87.7% chance of a 25 basis point cut at the September 18th meeting. A lot can happen between now and September 18th, but the odds are stacking up toward a rate cut in September.

The key will be to listen to Chairman Powell’s press conference after the release on Wednesday to see if he provides any clues as to what the Fed is thinking with regard to a cut in September.

For more on this topic, go back and read my piece from two weeks ago (link here), and as I said in that piece as it pertains to rate cuts:

“…the beginning of the rate cuts were also associated with the early stages of the market beginning to decline. So be careful what you wish for.”

Unemployment Report

The second key pieces of data this week are the jobs report and the unemployment rate releases on Friday. Both are very important but I want to focus on the unemployment rate today.

The unemployment rate for June (the most recent reading) was 4.1%.

The current consensus estimate for July (the report that will be released this Friday) is for the unemployment rate to remain unchanged at 4.1%.

This is important because if the unemployment rate comes in 0.1% higher than expected at 4.2%, the Sahm Recession Indicator will have been triggered.

I have written about the Sahm Recession Indicator in the past (both here and here); however, for those that may not be familiar, here is the definition of the rule:

“Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months.”

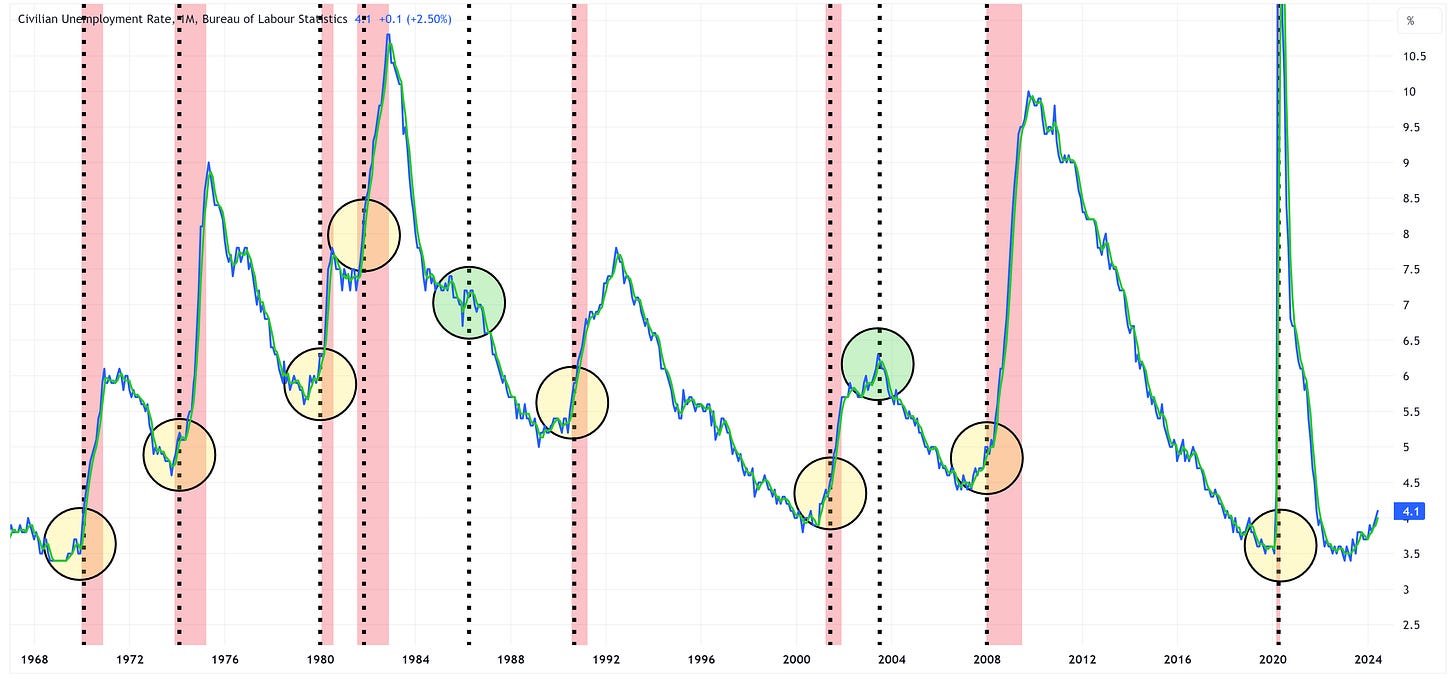

Here is a chart I have constructed showing the previous times the “Sahm Rule” has been triggered:

Vertical black dotted lines = Sahm Rule trigger date

Vertical red bars = US recessions

Very quickly you can see that the “Sahm Rule” has been triggered 10 times since the 1960s, and 8 of those 10 events have been associated with a recession.

So yes, this could fall into the 20% camp where a recession did not follow the triggering of the Sahm Rule; however, with the Fed on the cusp of cutting rates, it would seem that the reasonable response would be to err on the side of believing that the US economy is probably moving directionally towards a recession vs. away from a recession.

S&P 500 Index

Let’s check in with our “line in the sand” charts for the S&P 500 and NASDAQ.

The S&P 500 fell -0.83% last week and the low of the week was 5,390.95. Note that our weekly chart “line in the sand” value for the S&P 500 is 5,391.78. The market clearly respected the 5,391 level provided last week and bounced off of it.

Additionally, the market remains a good distance away from our monthly chart value of 4,876.77.

Net/net, there is no reason to panic at this point, but worth continuing to monitor given everything noted above.

NASDAQ 100 Index

The NASDAQ is a bit of a different story.

Our “line in the sand” on the weekly chart was 19,210.28 which was breached last week as the NASDAQ declined by -2.56%.

Keep reading with a 7-day free trial

Subscribe to Skillman Grove Research to keep reading this post and get 7 days of free access to the full post archives.